november 2021 child tax credit date

ET on November 15 to receive the monthly payment as a lump sum in December. The IRS allowed qualified individuals to receive 50 of their estimated child tax credit payment in 2021.

Child Tax Credit 2021 8 Things You Need To Know District Capital

File a free federal return now to claim your child tax credit.

. The fifth installment of the Child Tax Credit is just around the corner and it is falling on the same day as most of. That means the total advance payment of 4800 9600 x 50. Related services and information.

31 2021 so a 5-year-old turning 6 in 2021 will qualify for a maximum of 250 per month. While the October payments of the Child Tax Program have been sent out many parents have said they did not receive their September check. November 1 2021 is an important date for two different reasons.

For 2021 a legal dependent who is age 17 or younger as of December 31 2021 can qualify for the child tax credit. The updated Child Tax Credit is based on parents modified adjusted gross income AGI as reflected on their 2020 tax filing. Also the final date to opt out of the last payment for those who prefer to get a higher tax refund in 2022.

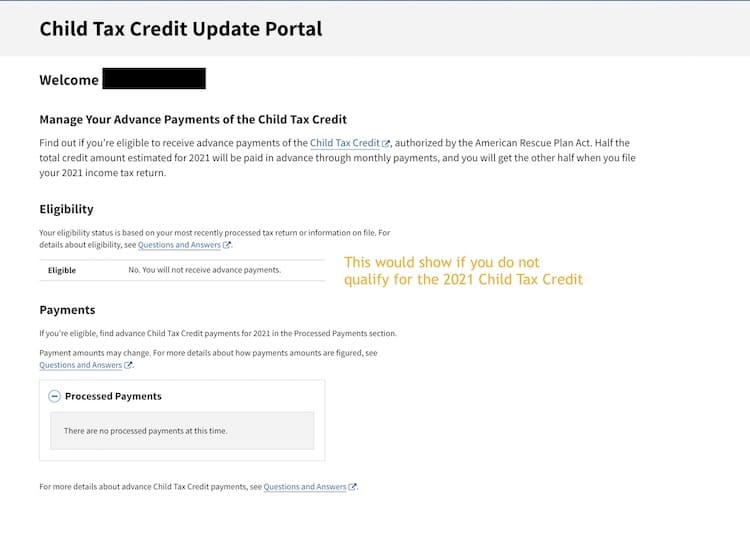

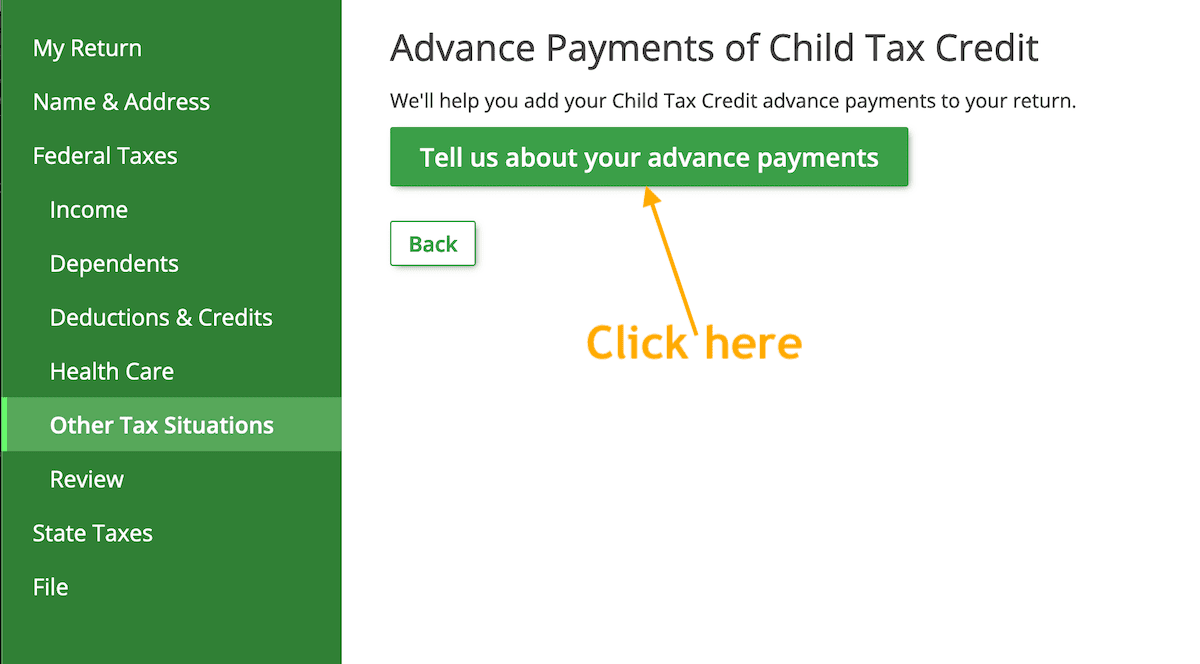

Wait 10 working days from the payment date to contact us. If you received advance payments you can claim the rest of the Child Tax Credit if eligible when you file your 2021 tax return. Advance child tax credit payments are early payments from the irs of 50 percent of the estimated amount of the child tax credit.

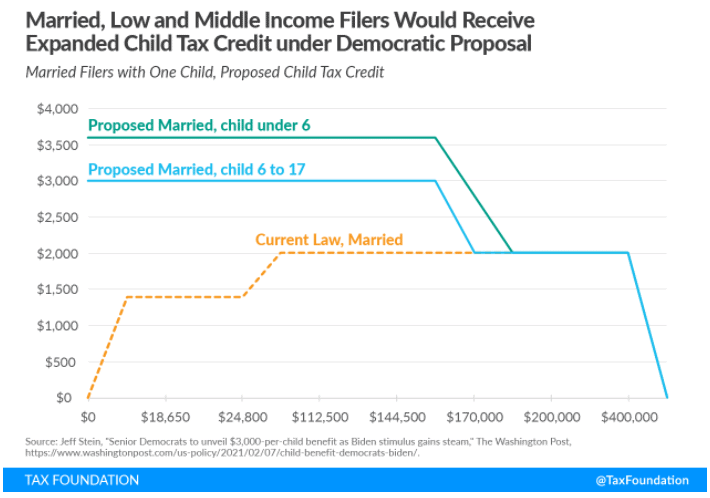

For 2021 the maximum child tax credit is 3600 per child age five or younger and 3000 per child between the ages of six and 17. Even so the enhanced CTC still has a benefit that parents can claim on their 2021 taxes before the April 15 2022 filing deadline. IRSnews IRSnews November 9 2021.

Benefit and credit payment dates. November 25 2022 Havent received your payment. Final Child Tax Credit Payment Opt-Out Deadline is November 29.

Is the Child Tax Credit for 2020 or 2021. Dates for earlier payments. In early February if their return involves the earned income tax.

Child Tax Credit FAQs for Your 2021 Tax Return. 15 opt out by Oct. Unlike in previous years the new credit also allows families with extremely low or no income to qualify for the entire benefit.

15 is also the date the next monthly child tax credit payment will be sent out. 2021 Child Tax Credit and Advance Payments. Alberta child and family benefit ACFB All payment dates.

What is the Child Tax Credit payment date in November 2021. However the deadline to apply for the child tax credit payment passed on November 15. IR-2021-218 November 9 2021.

What dates matter This year your 2021 tax return is due April. Those who have already signed up will receive their payments after they are issued. WASHINGTON The Internal Revenue Service today updated frequently-asked-questions FAQs for the 2021 Child Tax Credit and Advance Child Tax Credit Payments to describe how taxpayers can now provide the IRS an estimate of your 2021 income using the Child Tax Credit Update Portal CTC UP.

Missing the deadline could cost you in. Child Tax Credit. 15 when the final advance CTC payment rolls out.

Families who are eligible but havent signed up could receive the amount of all the advance payments as one lump sum if they opt-in for the final payment of 2021 before the deadline date. File a free federal return now to claim your child tax credit. For both age groups the rest of the payment.

The 2021 child tax credit provides parents with up to 3600 per child for kids under 6 and 3000 for all other children under 18 with half of the money being doled out as monthly payments that started this week. The monthly child tax credit payments which began in July are set to end in December. 1 was the deadline to change income banking or address information for that payment.

Thats because the expanded CTC divided the benefit between. THE DEADLINE to opt-out of the child tax credit for November is approaching and those who dont want to receive the next child tax credit have until November 1 2021 at 1159pm to decline it. IRS Updates 2021 Child Tax Credit Frequently Asked Questions Those who opt in on or before Nov.

Portal allows for income updates. Children also must have a Social Security number SSN to qualify for the 2021 child tax credit. Wait 5 working days from the payment date to contact us.

Under the American Rescue Plan of 2021 advance payments of up to half the 2021 Child Tax Credit were sent to eligible taxpayers. 15 will receive a lump-sum payment on Dec. The monthly payments are advances on 50 of the CTC that you can claim on your 2021 tax returns when you file your taxes in early 2022.

In other words. First starting on November 1 parents will be able to update their their income using the Child Tax Credit Update Portal which they werent able to do before. 29 What happens with the child tax credit payments after December.

The due date for opting out of the December 15 monthly child credit payments is almost here. This is the first year that 17-year-olds qualify for the CTC the previous age limit was 16. The IRS sent the sixth and final round of child tax credit payments to approximately 36 million families on December 15.

For 2021 the maximum child tax credit is 3600 per child age five or younger and 3000 per child between the ages of six and 17. They can use another portal to register to receive the enhanced child tax credit but must do so by 1159 pm.

Thousands Of Low Income Families To Get 1 800 Per Child Tax Credits Next Month

2021 Advanced Child Tax Credit What It Means For Your Family

Child Tax Credit United States Wikipedia

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

Your Complete Guide To 2021 U S Small Business Tax Credits Freshbooks Blog

How Does The 2021 Child Tax Credit Affect Your Income Taxes Goodrx

December S Payment Could Be The Final Child Tax Credit Check What To Know Cnet

Child Tax Credit 2022 Surprise New 4 000 Child And Dependent Care Credit Checks To Be Sent Are You Eligible

2021 Child Tax Credit Steps To Take To Receive Or Manage

2021 Child Tax Credit Steps To Take To Receive Or Manage

2021 Child Tax Credit Here S Who Will Get Up To 1 800 Per Child In Cash And Who Will Need To Opt Out Cbs News

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

More Than 12 Billion In Lihtc Provisions And Nearly 6 Billion For Neighborhood Homes Tax Credits In Nov 3 Draft Of The Build Back Better Reconciliation Bill Would Finance Close To 1

October Child Tax Credits Issued Irs Gives Update On Payment Delays

How To Claim The Child Tax Credit For A Baby Born In 2021 Goodrx

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities